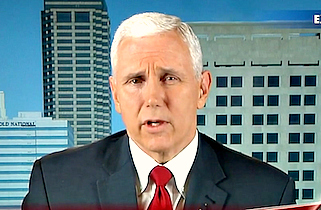

When Republican presidential candidate Donald Trump chose Indiana Gov. Mike Pence as his running mate, he dealt a potentially serious blow to his fundraising prospects, lawyers are saying.

When Republican presidential candidate Donald Trump chose Indiana Gov. Mike Pence as his running mate, he dealt a potentially serious blow to his fundraising prospects, lawyers are saying.

Pence is a sitting governor. That means contributions to the ticket will be limited by the SEC’s 2010 pay to play rule, also known as Rule 206(4)-5 of the Investment Advisers Act of 1940, as amended. The rule prevents “SEC registered investment advisers” from contributing more than $250-$350 to state or local officials who could select the firm that would manage a state or local pension fund, or some part of it.

That means most hedge funds and private equity firms — their PACs, their executives, their fund managers and probably their investor relations staff — can’t give to the ticket. If they violate the rule, they face a two-year ban on managing Indiana’s pension money — or at least, on collecting management fees and a percentage of the profits they earn for the funds, which certainly takes all the fun out of it for firms.

The Indiana Public Retirement System had about $29.9 billion in assets under management at the end of 2015.

That was a big problem for Wisconsin Gov. Scott Walker‘s presidential fundraising, and for New Jersey Gov. Chris Christie‘s, and it will be for Trump’s too.

“It will cause most of the major players on Wall Street and financial service firms to not contribute and will even prohibit soliciting funds for the campaign,” said Kenneth Gross, a partner at Skadden Arps and expert on campaign finance. “The implications to any such covered donor could be draconian.”

This rule doesn’t cover contributions to super PACs on its face, said Gross, but “most bankers have stayed away from doing that” because it invites the SEC, not just the FEC, to look at whether super PACs and candidates are coordinating. If the SEC determines that they are, it could invoke pay to play.

And while the FEC has been widely described as dysfunctional and toothless in its current iteration, the same is decidedly not true of the securities oversight agency.

Viveca Novak works for opensecrets.org, a non-partisan nonprofit organization which tracks money in U.S. politics.