A couple of Republicans and one Democrat on the Senate Intelligence Committee, among others, were accused of unloading stocks ahead of the market crash based on information from a confidential coronavirus briefing. Another Senate Republican is being scrutinized for selling his stake in a private company.

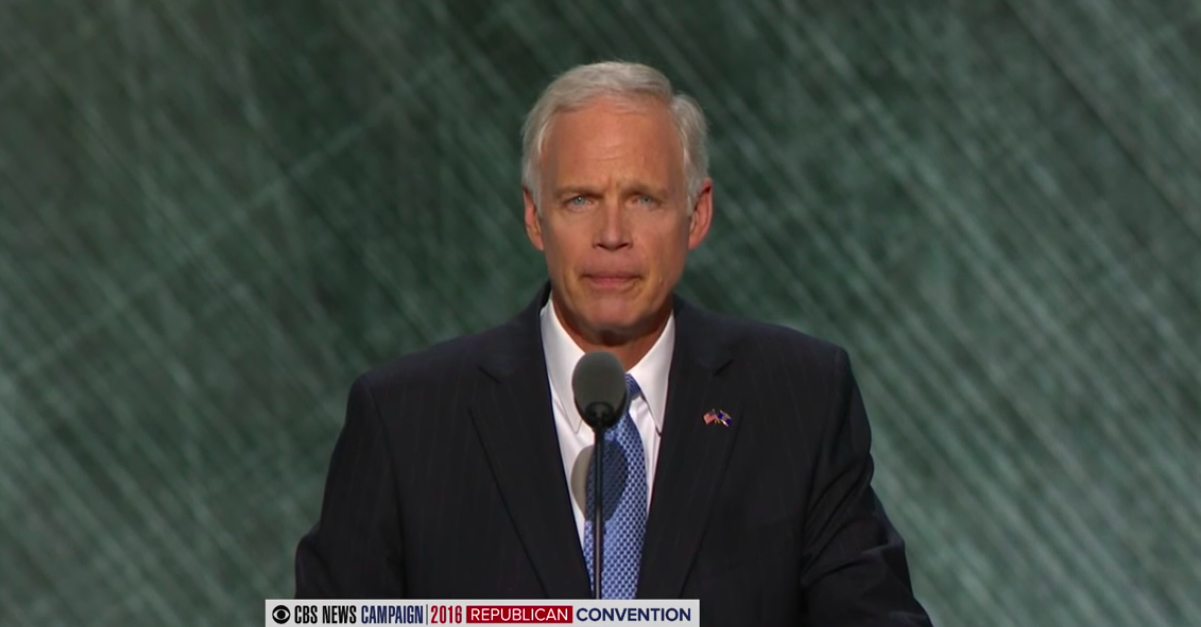

Senate Homeland Security and Governmental Affairs Committee Chairman Ron Johnson (R-Wisc.) on Friday defended his decision to sell his share of a family-owned plastics company currently run by his brother–valued between $5 million and $25 million. The March 2, transaction occurred just days before equities plummeted as the pandemic brought the global economy to its knees, leading critics to speculate if Johnson based his decision on non-public information and future projections obtained in his role as a public servant.

Johnson denied that his decision was in any way related to the coronavirus or the state of the market, telling the Milwaukee Journal Sentinel that the deal had been in the works since 2018.

Johnson, who currently chairs a committee investigating Joe Biden’s son Hunter Biden, was the company’s chief executive officer before he left the company in 2010 when he won his Senate seat.

Johnson spokesperson Ben Voelkel reiterated the senator’s position in an email to the Journal Sentinel.

“Unequivocally unrelated to the coronavirus. This transaction is the result of an investment by a private firm in Pacur, and Gryphon was excited enough about it that they sent out a press release,” Voelkel wrote. “Any attempts to make this seem like anything else are just sad partisan smear tactics and proactive spreading of misinformation.”

Johnson’s sale of his stake in Pacur LLC, a private company that doesn’t issue publicly traded stock, appears markedly different from the transactions of his Senate colleagues.

https://twitter.com/donmoyn/status/1240832114855153664?s=20

But not everyone was convinced that the sale was entirely innocent.

Wisconsin’s Democratic Lt. Gov. Mandela Barnes insinuated that the lucrative transaction was suspiciously prognostic and unseemly in light of the economic hardships facing the majority of the country.

“People are losing their jobs and their small businesses while our senior U.S. Senator sold between 5 and 25 million right before the market crash,” Barnes commented. “No ‘foresight’ is that good. How many people lost a fraction of what he made, but may never be able to recover. This is sick.”

National security attorney Mark Zaid, who was part of the legal team that represented the Ukraine whistleblower, said the transaction was worthy of an investigation.

[image via YouTube]

Have a tip we should know? [email protected]