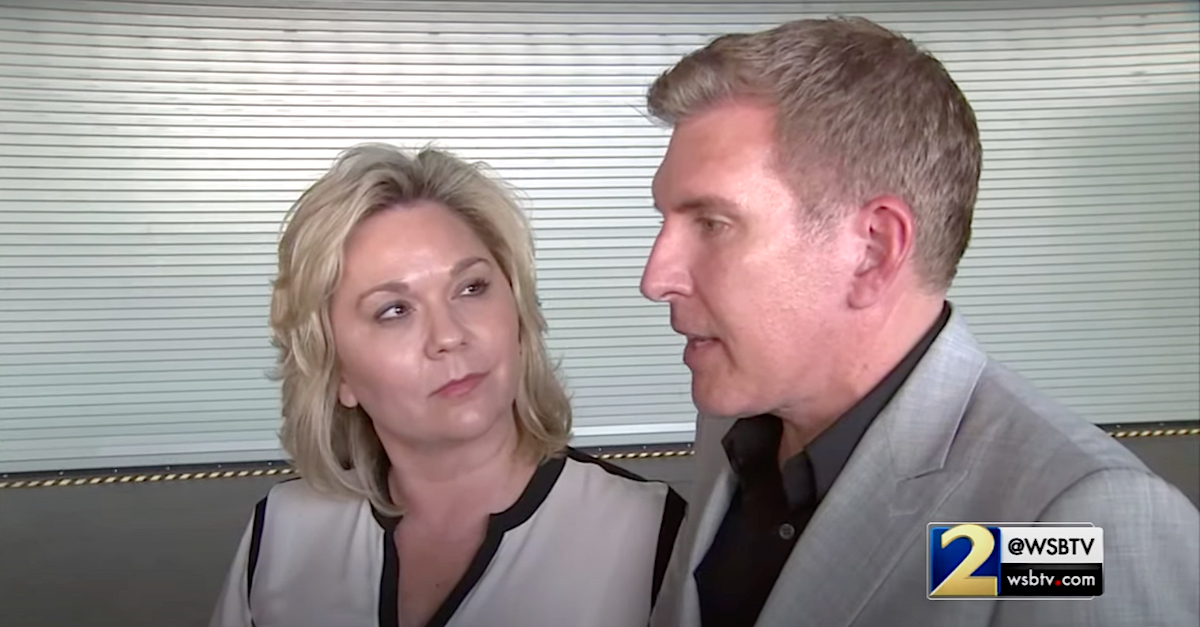

Julie Chrisley and Todd Chrisley. (Image via WSB-TV screengrab.)

The stars of the reality television show Chrisley Knows Best have been convicted of conspiracy to defraud the IRS and “a number of tax crimes,” the U.S. Attorney’s Office for the Northern District of Georgia announced on Tuesday.

A jury convicted Todd and Julie Chrisley of “conspiring to defraud community banks out of more than $30 million of fraudulent loans,” federal prosecutors wrote. The jury also convicted the couple’s accountant, Peter Tarantino, of several crimes.

“The Chrisleys were found guilty of tax evasion, and Peter Tarantino was found guilty of filing two false corporate tax returns on behalf of the Chrisleys’ company,” prosecutors wrote. “The jury also found Julie Chrisley guilty of wire fraud and obstruction of justice.”

Here’s how the feds summarized the case:

Before Todd and Julie Chrisley became reality television stars, they conspired to defraud community banks in the Atlanta area to obtain more than $30 million in personal loans. The Chrisleys, with the help of their former business partner, submitted false bank statements, audit reports, and personal financial statements to banks to obtain the millions of dollars in fraudulent loans. The Chrisleys then spent the money on luxury cars, designer clothes, real estate, and travel—and used new fraudulent loans to pay back old ones. After spending all the money, Todd Chrisley filed for bankruptcy and walked away from more than $20 million of the fraudulently obtained loans.

The evidence further showed that in 2014, while Todd Chrisley was in bankruptcy proceedings, Julie Chrisley again manufactured financial documents and lied to real estate agents to obtain a luxury rental house in Los Angeles, California. As soon as the Chrisleys began renting the house, they failed to pay rent, and the homeowner filed an eviction lawsuit.

“Around the time that Todd Chrisley filed for bankruptcy, the Chrisleys became the stars of their own reality show, which was recorded in Atlanta and later in Nashville,” the U.S. Attorney’s Office continued. “The evidence at trial showed that while they were earning millions from their TV show, Todd and Julie Chrisley, along with their accountant, Peter Tarantino, conspired to defraud the Internal Revenue Service.”

The DOJ continued by pointing to claims Todd Chrisley made on a radio show about his tax liabilities — statements the DOJ said the trial proved were lies:

Throughout the conspiracy, the Chrisleys operated a loan-out company that received their income earned from their show and other entertainment ventures. To evade collection of half a million dollars in delinquent taxes owed by Todd Chrisley, the Chrisleys opened and kept the corporate bank accounts only in Julie Chrisley’s name. One day after the IRS requested information about bank accounts in Julie Chrisley’s name, the Chrisleys transferred ownership of the corporate bank account to Todd Chrisley’s mother in an effort to further hide his income from the IRS. All the while, Todd Chrisley operated the loan-out company behind the scenes and controlled the company’s purse strings.

While the Chrisleys were earning millions and evading paying Todd Chrisley’s delinquent back taxes, they also failed to file tax returns or pay any taxes for the 2013, 2014, 2015, and 2016 tax years. At one point, Todd Chrisley falsely claimed on a radio program that he paid $750,000 to $1 million in federal income taxes every year, even though he had not filed or paid his personal income tax returns for years. Tarantino was also convicted of filing two false corporate tax returns for the loan-out company, which falsely claimed that the company earned no money and made no distributions in 2015 and 2016.

Julie Chrisley was also convicted of obstruction of justice, the DOJ said, for submitting a “fraudulent document in response to a grand jury subpoena to make it appear that the Chrisleys had not lied to the bank when they transferred ownership of the loan-out company’s bank account to Todd Chrisley’s mother.”

“Julie Chrisley transmitted this document with the intent of impeding the grand jury’s investigation into her and her husband and avoiding prosecution,” federal prosecutors said.

A jury deliberated for about four hours on June 3 and all day on June 6 before delivering a verdict on June 7, according to a federal court docket.

A sentencing hearing is scheduled for October 6. The court docket says that the Chrisleys have been ordered to submit to location monitoring services and to serve home detention until they are sentenced.

“The jury found that Todd and Julie Chrisley committed multiple fraud schemes for several years and their accountant, Peter Tarantino, filed false corporate tax returns on their behalf,” U.S. Attorney Ryan K. Buchanan said in a press release. “This office and our partner agencies will continue to vigorously investigate and prosecute white collar criminals who flout the law.”

“As today’s outcome shows, when you lie, cheat and steal, justice is blind as to your fame, your fortune, and your position,” said Keri Farley, Special Agent in Charge of FBI Atlanta. “In the end, when driven by greed, the verdict of guilty on all counts for these three defendants proves once again that financial crimes do not pay.”

“Todd Chrisley, Julie Chrisley and their Certified Public Accountant, Peter Tarantino, conspired to evade the assessment and payment of the Chrisley’s income taxes. The Chrisleys and Tarantino knew the law was clear on taxable income and who is required to file and pay taxes,” said James E. Dorsey, Special Agent in Charge, IRS-Criminal Investigation. “These convictions should send a clear message regardless of your fame or notoriety, everyone will be held accountable for paying their fair share of taxes.”

Read the indictment, a superseding indictment, and the detention order below: