The chairman of the House Ways and Means Committee formally requested on Wednesday the last six years’ worth of President Donald Trump‘s tax returns, citing what’s been dubbed a “little-known provision” in tax code to do so.

Rep. Richard Neal (D-Mass.) wrote a letter to IRS Commissioner Charles Rettig, citing his authority pursuant to 26 U.S. Code § 6103(f). That says the following:

Upon written request from the chairman of the Committee on Ways and Means of the House of Representatives, the chairman of the Committee on Finance of the Senate, or the chairman of the Joint Committee on Taxation, the Secretary shall furnish such committee with any return or return information specified in such request, except that any return or return information which can be associated with, or otherwise identify, directly or indirectly, a particular taxpayer shall be furnished to such committee only when sitting in closed executive session unless such taxpayer otherwise consents in writing to such disclosure.

Neal said that the Committee is “considering legislative proposals and conducting oversight related to our Federal tax laws, including, but not limited to, the extent to which the IRS audits and enforces the Federal tax laws against a President.”

“Under the internal Revenue Manual, individual income tax returns of a President are subject to mandatory examination, but this practice is IRS policy and not codified in the Federal tax laws,” Neal wrote. “It is necessary for the Committee to determine the scope of any such examination and whether it includes a review of underlying business activities required to be reported on the individual income tax return.”

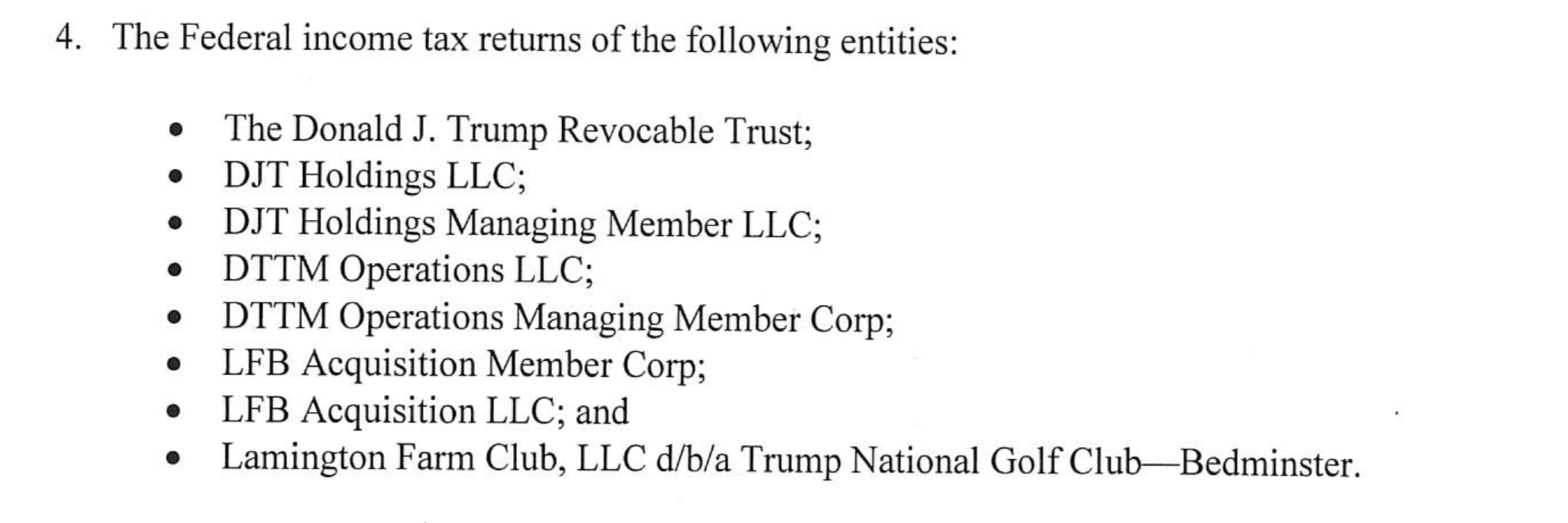

Having cited the authority mentioned above, Neal numbered seven areas to be responsive to the request. These included: Trump’s 2013-2018 tax returns; tax returns of eight Trump-related entities (pictured below); statements about whether these tax returns are or were ever under audit (as Trump has repeatedly said in an effort not to release his personal tax returns); statements as to why there was an audit if there was one; all administrative files related to Trump and these entities; a statement in the event that Trump or these entities did not file tax returns last year.

Neal has set April 10 as the deadline for the IRS to fulfill the request.

“I take the authority to make this request very seriously, and I approach it with the utmost care and respect. This request is about policy, not politics; my preparations were made on my own track and timeline, entirely independent of other activities in Congress and the administration,” Neal said in a statement. “I trust that in this spirit, the IRS will comply with federal law and furnish me with the requested documents in a timely manner.”

University of Iowa Law Prof. Andy Grewal, a tax policy scholar, told Law&Crime he was skeptical that Neal needs Trump’s tax returns to accomplish his expressed goal.

“Neal states that the committee must determine whether the IRS audits Presidents. It seems doubtful that the committee needs all of a President’s tax returns to make that determination,” Grewal said. “Rather, the committee would be on firmer ground if it asked for documentation confirming that audit processes were followed or asked to speak to officials who oversee the audit process.”

Richard Neal’s Letter to the IRS by Law&Crime on Scribd

Editor’s note: this story was updated after publication with comment from Prof. Grewal.

[Image via Nicholas Kamm/AFP/Getty Images]