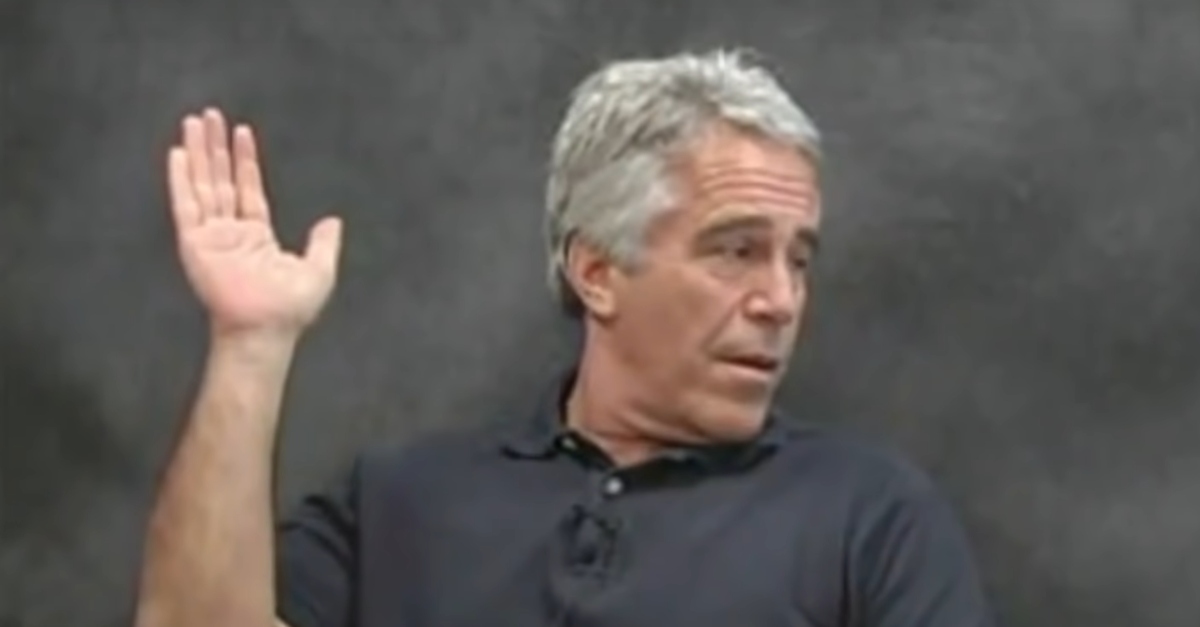

Jeffrey Epstein (Image via CBSN)

JPMorgan Chase, the world’s largest bank by market capitalization, minced no words and made no apologies in its motion to dismiss what they called a “legally meritless” lawsuit by the U.S. Virgin Islands accusing them of bankrolling Jeffrey Epstein’s sex trafficking crimes.

“Having sought and obtained more than $100 million from Jeffrey Epstein’s estate and businesses for damages caused by his sex-trafficking crimes, the United States Virgin Islands (USVI) now casts farther afield for deeper pockets,” the megabank’s lawyer Felicia H. Ellsworth, from the billion-dollar firm WilmerHale, wrote in a 32-page memo supporting its motion to dismiss. “But this suit involves neither Epstein’s estate, nor his businesses, nor his victims.”

In November, the Virgin Islands entered into a roughly $105 million deal with Epstein’s estate, which called for the sale of the late predator’s notorious Little St. James. Locals called Epstein’s former property “Pedophile Island,” but the attorney general’s office declared that the settlement ensured that it would no longer be used for “illicit purposes.”

The wide-ranging agreement, however, did not end the Virgin Islands’ regulatory actions.

Its former Attorney General Denise George filed the lawsuit against Little St. James on Dec. 27, 2022, then lost her job days later.

Virgin Islands Attorney General Denise George lost her job after suing JPMorgan Chase in connection with her Jeffrey Epstein investigation. (Photos via VI DOJ / US DOJ)

Local news outlets in the Virgin Islands reported that the attorney general had not informed the territory’s Gov. Albert Bryan about her impending enforcement action, though his office disputed the accuracy of those reports.

The litigation continues under the AG’s successor Carol Thomas-Jacobs, and JPMorgan Chase now wants a federal judge in New York to dismiss it, claiming the Virgin Islands is blaming them for their own sins.

“USVI’s lawsuit is a masterclass in deflection that seeks to hold JPMC responsible for not sleuthing out Epstein’s crimes over a decade ago,” the bank’s memo states. “Yet USVI had access at the time to the same information, allegations, and rumors about Epstein on which it alleges JPMC should have acted. Indeed, as a law-enforcement agency, USVI had access to much more, along with the investigative advantage of physical proximity to Epstein’s crimes.”

JPMorgan Chase and Deutsche Bank also face separate lawsuits from Epstein’s victims accusing them of “complicity” in the sex trafficking scheme.

Filed anonymously by Jane Doe on behalf of a class of victims, one of those complaints notes that JPMorgan Chase provided financial services to Epstein from 1998 through August 2013. That relationship extended well beyond Epstein’s decision in 2008 to plead guilty to two “prostitution” charges in order to enter into a non-prosecution agreement (NPA) purportedly shielding his co-conspirators.

Epstein’s now-convicted accomplice Ghislaine Maxwell unsuccessfully tried to invoke that agreement in a bid to escape her own sex trafficking charges.

Though the Virgin Islands and Epstein’s victims argue that the 2008 deal should have put the bank on notice, JPMorgan Chase said that it only notified them of far less serious crimes than what was publicized by authorities.

“The Complaint’s allegation as to actual wrongdoing observes that Epstein pled guilty to Florida solicitation of a minor in 2008, […] a different offense with different elements that did not involve the use of JPMC funds and did not establish that Epstein was engaged in any ongoing conduct against any specific person,” a footnote of the memo states. “It is thus insufficient to establish that JPMC recklessly facilitated ‘a particular‘ sex-trafficking venture through provision of general banking services to Epstein.”

The Virgin Islands sued under the Trafficking Victims Protection Act (TVPA), a local racketeering analog known as the Criminally Influenced and Corrupt Organizations Act (CICO), and a consumer protection claim.

As to the CICO allegation, the bank says it didn’t “conduct or participate in the affairs of the alleged ‘Epstein Enterprise.'”

JPMorgan Chase’s motion is pending before Senior U.S. District Judge Jed S. Rakoff, a staunch critic of Wall Street who recently signaled that he would approve a $26 million settlement between Deutsche Bank and shareholders over the German bank’s ties to Epstein and Russian oligarchs. The parties went to the bargaining table after Rakoff refused to dismiss the shareholders’ suit.