Elon Musk attends The 2022 Met Gala Celebrating “In America: An Anthology of Fashion” at The Metropolitan Museum of Art on May 2, 2022 in New York City.

Twitter followed through on its promise to sue billionaire Elon Musk on Tuesday, lambasting the Tesla co-founder’s “public spectacle” and asking a court to compel the $44 billion merger deal to the letter.

“Having mounted a public spectacle to put Twitter in play, and having proposed and then signed a seller-friendly merger agreement, Musk apparently believes that he — unlike every other party subject to Delaware contract law — is free to change his mind, trash the company, disrupt its operations, destroy stockholder value, and walk away,” Twitter’s attorney Peter J. Walsh, Jr. wrote in a 62-page complaint.

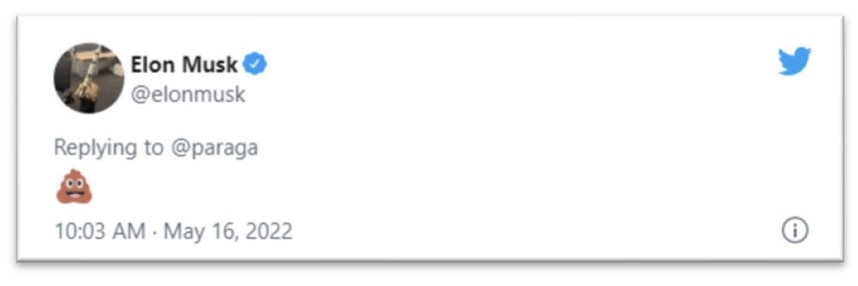

Featuring 179 pages of exhibits, the mammoth court filing embeds Musk’s prolific tweets that Twitter says violates a non-disparagement clause. Two Delaware corporations created for the purpose of completing the merger deal, X Holdings I, Inc. and X Holdings II, Inc., are listed as Musk’s co-defendants.

Twitter filed the complaint in Delaware’s Court of Chancery, a 230-year-old court with an outsized role in presiding over U.S. business disputes because of its location in a state home to many major American corporations. It is known for its speedy docket and its strict enforcement of contracts. The court of chancery focuses on “equity” — or remedies such as specific performance or injunctions — whereas courts of law focus on money damages as compensation. In most U.S. states, the courts of equity and law have long ago been merged.

The social media giant says its board became concerned by Musk’s “rapid accumulation of Twitter stock and take-it-or-leave-it offer” that the billionaire might launch a hostile tender notice.

Musk amplified those concerns with cheeky tweets, posting a pair of pop culture-infused tweets in April: “Love Me Tender” and “______ is the Night.”

The San Francisco-based social media giant says that it insisted upon a non-disparagement clause because of Musk’s itchy Twitter finger, but the billionaire would not be deterred, repeatedly tweeting his skepticism of the company’s estimate that less than 5 percent of its accounts were spam bots.

The Securities and Exchange Commission has sued Musk in the past for tweets that have moved markets, entering into a consent decree with federal regulators in late 2018 over an alleged plan to take Tesla private.

“Am considering taking Tesla private at $420,” Musk tweeted on Aug. 7, 2018, in a dollar figure widely interpreted as an allusion to cannabis culture. “Funding secured.”

Twitter’s lawsuit appears to gloss over Musk’s tangled history with its platform and stock markets. Musk now has more than 100 million followers, and he has spent the length of his negotiations with the platform slamming the company over its alleged “spam bot” problem.

The company said that Musk tweets about his own sampling of Twitter accounts had a “misrepresentation.”

“Twitter noted that Musk, while continuing to accuse Twitter of misrepresenting its spam or false account estimate, had offered not a single fact to support the accusation,” the complaint states.

One of the tweets flagged in the complaint as allegedly violating the non-disparagement clause was simply a feces emoji.

Musk’s attorney Alex Spiro did not immediately respond to Law&Crime’s email requesting comment.

Twitter demands specific performance of Musk’s obligations under the merger agreement, including his plan to buy the company for $54.20 per share in cash, for a total of about $44 billion.

Some legal observers have questioned whether Musk will comply with a court order to follow through on the merger if one is entered against him.

Read the voluminous legal filings, including the complaint, below:

(Photo by Dimitrios Kambouris/Getty Images for The Met Museum/Vogue)