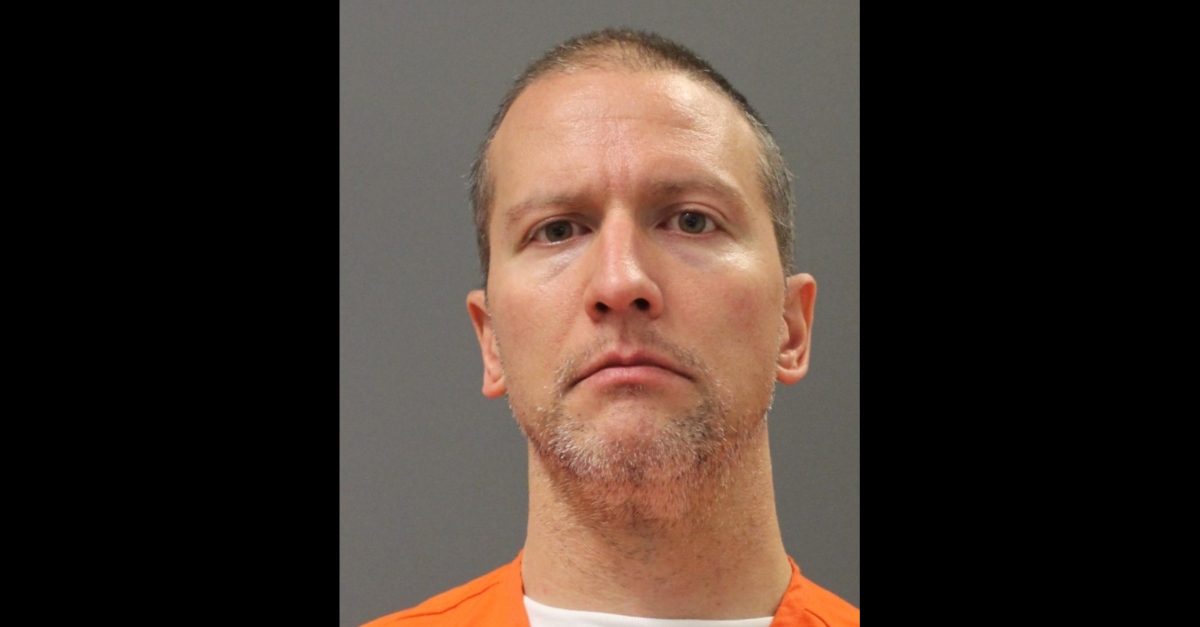

Derek Chauvin, 44, the former Minneapolis police officer charged with second-degree murder in the death of George Floyd, and his wife Kellie May Chauvin were charged with nine counts of felony tax fraud by the Washington County, Minn. Attorney’s Office on Tuesday.

According to the complaint, investigators with the Minnesota Department of Revenue (MDOR) were assigned on June 12 to investigate the Chauvins for possible income tax violations. The investigation revealed that the couple failed to file Minnesota income tax returns for the years 2016, 2017, and 2018, the prosecutor alleges.

Investigators determined that the Chauvins’ income was significantly over the minimum threshold requiring them to file returns for those years and that the couple “lived, worked, and had significant connections to the State of Minnesota.”

Prosecutors claim that the Chauvins “were aware of their obligation to pay Minnesota income taxes” and cited to MDOR’s multiple attempts to contact the couple regarding their obligations to the state—and to warn them of the criminal liability that would accompany their failure to respond.

“In October 2019 a ‘request or missing return’ letter was sent to D. Chauvin for the 2016 income tax return. A second letter was sent in January 2020,” the complaint stated.

“In September 2019 a ‘request for missing return’ letter was sent to K. Chauvin for her missing 2016 income tax return. A second letter was sent in December 2019. All letters warned the Chauvins that they could be the subject of criminal penalties if no returns are filed. MDOR sent K. Chauvin a Commissioner Filed Return notifying her that an assessment of tax was issued after she did not respond to the request for missing return letters. This does not relieve the obligation to file a tax return. Again the letter warned K. Chauvin about criminal penalties for not filing a return.”

The complaint also contained an incriminating excerpt from a June 26 phone conversation between the couple one day after a search warrant was executed on their home. Derek Chauvin was at the time an inmate at the Minnesota Correctional Facility at Oak Park Heights where all calls are recorded.

“K. Chauvin told D. Chauvin that people were looking into their unfiled tax returns,” the complaint stated.

“In the call, K. Chauvin tells D. Chauvin that she is meeting with somebody about ‘16 to now.’ D. Chauvin suggests using ‘who we have used to handle for many years.’ K. Chauvin responds, ‘Yeah well we don’t want to get your dad involved because he will just be mad at me I mean us for not doing them for years.'”

Derek Chauvin in May was charged as the lead defendant in the death of 46-year-old Floyd which sparked anti-police brutality protests across the globe. According to prosecutors, Chauvin kneeled on the Floyd’s neck during an arrest for eight minutes and 46 seconds, even after the Floyd became unresponsive, prosecutors say.

All four officers involved with the incident were fired from the Minneapolis Police Department. Thomas Lane, J. Alexander Kueng, and Tou Thao are charged with aiding and abetting second-degree murder and aiding and abetting second-degree manslaughter.

Read the full tax complaint against Derek Chauvin and his wife below.

PDF Chauvin Complaint by Law&Crime on Scribd

[image via Minnesota Department of Corrections]