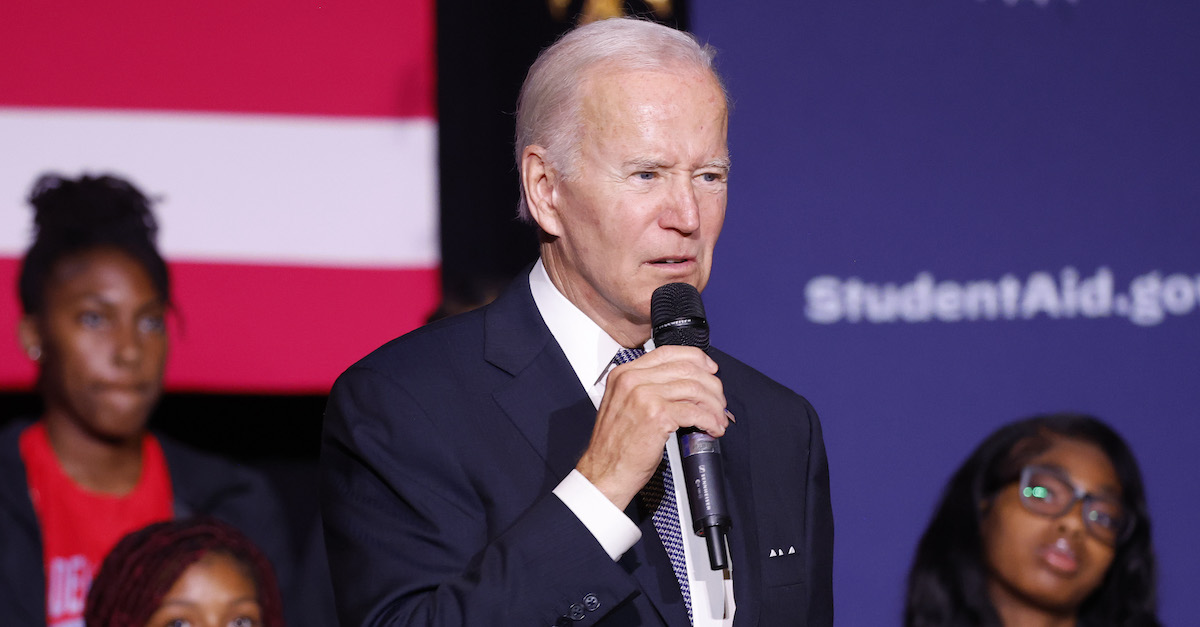

President Joe Biden gives remarks on student debt relief at Delaware State University on October 21, 2022 in Dover, Delaware. (Photo by Anna Moneymaker/Getty Images.)

A federal appeals court on Friday temporarily stopped the Biden Administration from forgiving the student loans of millions of borrowers — but the White House has encouraged borrowers to continue to apply for relief.

The court’s move came after a coalition of Republican-led states — Nebraska, Missouri, Arkansas, Iowa, Kansas, and South Carolina — sued over Joe Biden’s signature student debt program.

“The Supreme Court just warned federal agencies against ‘asserting highly consequential power beyond what Congress could reasonably be understood to have granted,'” the states wrote in an emergency motion for an injunction that quoted West Virginia v. EPA, a recent case. “Yet the Biden Administration is doing exactly that through its Mass Debt Cancellation, which will erase over $400 billion of the $1.6 trillion in outstanding federal student loan debt.”

The legal issue, according to the states, is whether the president can use the HEROES Act, which was passed in the wake of the Covid-19 pandemic, as the necessary hook upon which to hang the program. According to the states, the Biden Administration has stretched the meaning of the Act beyond the pale: the loan forgiveness program, according to the aforementioned coalition, “exceeds the Administration’s authority, violates the separation of powers, and is hopelessly arbitrary.”

The states said “no borrower will be disadvantaged” by a temporary pause of the program “because loan repayments and interest accruals are paused, and the Department [of Education] can continue that forbearance while this appeal is pending.”

A lower district court judge ruled that the states do not have standing to challenge the loan forgiveness program.

However, Nebraska asserted that it has standing to sue because it invests in so-called “student-loan asset-backed securities (SLABS),” which in turn hold Direct Loan Program and Federal Family Education Loan (FFEL) balances.

“The Nebraska Investment Council (NIC) — which invests assets of the State of Nebraska, including the pension fund, see Neb. Rev. Stat. §72- 1239.01 — has tens of millions of dollars in SLABS,” the state pointed out.

Missouri said it functions as a “customer-support provider” and otherwise services direct student loans under MOHELA, the Higher Education Loan Authority of the State of Missouri, thus earning “millions of dollars of revenue per year” that would be lost if some of the loans suddenly vanished at Biden’s behest.

According to Missouri, the following is how the lower district court botched the analysis of whether the state has standing to sue Biden (we’ve omitted the legal citations):

The district court dismissed MOHELA’s interests by claiming that the “financial harms” to MOHELA “are not attributable to” Missouri. But MOHELA is a state entity within Missouri’s Department of Higher Education and Workforce Development run by state officials performing essential state functions. That entity’s undisputed financial harms directly affect Missouri by hindering MOHELA from advancing its essential public purposes. Missouri has standing “to protect” these “rights and interests of the state” in court.

The district court, according to Missouri, found it relevant that “Missouri’s general revenues are not available to pay MOHELA’s debts” — a distinction Missouri said was not important.

“Nebraska, Iowa, Kansas, and South Carolina face a ‘direct injury in the form of a loss of specific tax revenues,'” the states then asserted by quoting Wyoming v. Oklahoma, a 1992 U.S. Supreme Court case.

The states also said they face some form of imminent financial doom if the loans are forgiven now.

“Under existing law, the States are set to tax a substantial amount of student loan debt discharge after 2025,” the states wrote. “Because the Cancellation will immediately reduce the pool of debt to discharge in the future, it will result in less for the States to tax.”

The states pointed out that Biden “declared” on in September on the television program “60 Minutes” that “[t]he pandemic” was “over” — thus raising additional questions about his administration’s use of the HEROES Act to forgive billions in loans.

The states then noted that one analysis placed the balance to be forgiven as high as $519 billion.

In another emergency motion — this one for an administrative stay of the loan forgiveness program — the states said Biden’s move “threaten[ed] the investments of Arkansas and Nebraska state entities” and “impose[d] enormous tax revenue losses on Nebraska, Iowa, Kansas, and South Carolina.”

The Eighth Circuit Court of Appeals issued a Friday order that approved the request for an administrative stay. The pause is temporary.

“Appellants’ emergency motion for an administrative stay prohibiting the appellees from discharging any student loan debt under the Cancellation program until this Court rules on the appellants’ motion for an injunction pending appeal is granted,” the appellate court wrote in an order that was not signed by any particular judge.

The order then established an expedited briefing schedule for the case.

The Biden Administration must respond to the move by 5 p.m. Monday. The aforementioned collection of states must issue a reply, if they so choose, by 5 p.m. Tuesday.

The White House responded to the pause by issuing the following statement, which was obtained by Law&Crime’s sister site Mediaite:

Tonight’s temporary order does not prevent borrowers from applying for student debt relief at studentaid.gov – and we encourage eligible borrowers to join the nearly 22 million Americans whose information the Department of Education already has. It also does not prevent us from reviewing these applications and preparing them for transmission to loan servicers.

It is also important to note that the order does not reverse the trial court’s dismissal of the case, or suggest that the case has merit. It merely prevents debt from being discharged until the court makes a decision.

We will continue to move full speed ahead in our preparations in compliance with this order. And, the Administration will continue to fight Republican officials suing to block our efforts to provide relief to working families.

The two emergency motions and the court’s order are available to read here.

Have a tip we should know? [email protected]