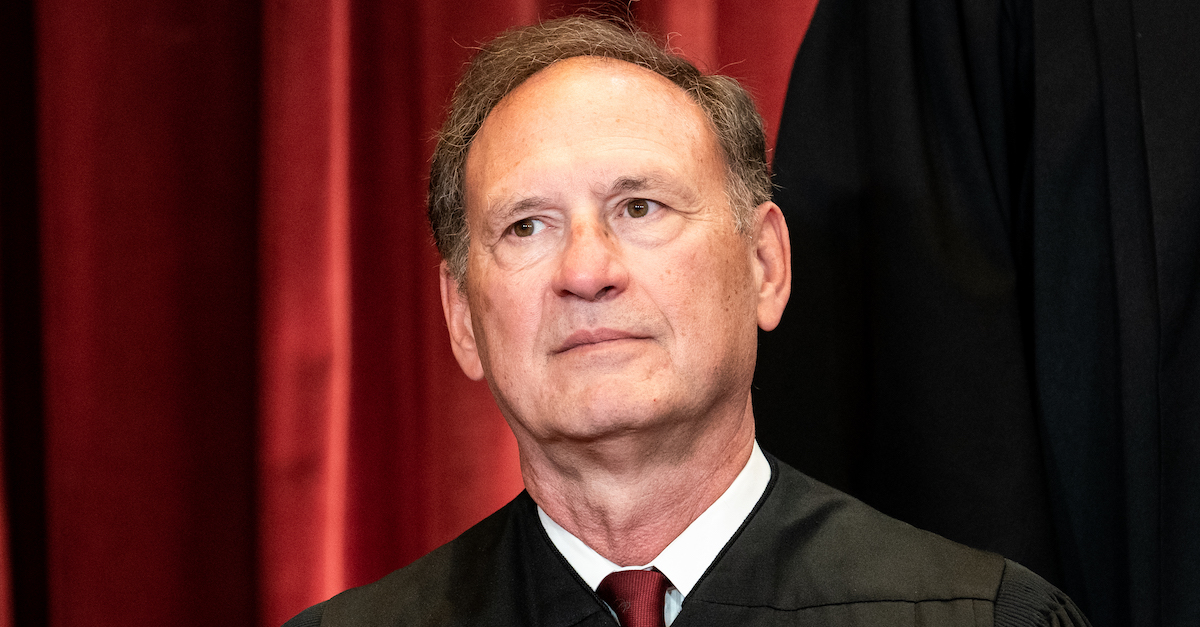

Associate Justice Samuel Alito

Justices Samuel Alito, Clarence Thomas, and Neil Gorsuch appeared displeased in an official statement Monday that legal “complications” deprived them of an opportunity to rule on a problematic and costly Medicaid rule.

The Supreme Court of the United States denied certiorari Monday in Texas v. Commissioner of Internal Revenue, thus leaving in place a federal rule that some say violates constitutional rules against delegating legislative authority to non-government entities.

The 2010 Affordable Care Act imposed a tax on all health insurance providers, including the health maintenance organizations (HMOs) used by states to run their Medicaid programs. The amount of the tax due from each provider was assessed each year based on that provider’s individual market share. State governments, in turn, would then reimburse the HMOs for any taxes paid.

Problematically, however, federal law requires that individual states fund their Medicaid programs “on an actuarially sound basis” without Congress’ having ever specified what “actuarially sound” means. The Department of Health and Human Services (HHS) defined “actuarially sound” to mean comporting with standards set by the American Academy of Actuaries (AAA). The issue with such a standard, however, is that AAA is a private entity.

Texas and four other states brought a federal lawsuit against HHS to recoup the funds it paid to HMOs for tax reimbursements. The crux of Texas’ lawsuit was that HHS illegally delegated its authority to a private organization, resulting in a private actuarial group improperly holding power over individual states. Theoretically, the AAA could deprive a state of the ability to participate in Medicaid if it refused to certify that state’s payment structure as not “actuarially sound.”

The underlying tax at issue — known as Health Insurance Provider Fee (HIPF) — was repealed in 2020. The HHS rule that allows the AAA rule to apply to state Medicaid payments, however, is still in effect.

The private non-delegation doctrine is a principle of constitutional and administrative law that prohibits legislative bodies from delegating their powers to private entities. The principle stems from general separation of powers tenets, just as the general non-delegation doctrine prohibit Congress from delegating legislative authority to other branches of government.

The US. District Court sided with the state plaintiffs, holding that that HHS had violated the private non-delegation doctrine. A panel of the U.S. Court of Appeals for the Fifth Circuit, however, reversed in 2020, and denied a rehearing en banc. Texas and the others, therefore, petitioned SCOTUS for certiorari.

In a four-page statement on the Court’s denial of certiorari, Alito (joined by Thomas and Gorsuch) called the dispute presented “an important separation-of-powers question.” Alito explained that the prohibition against delegating regulatory authority to private entities exists “to ensure the Government remains accountable to the public.” Allowing a private entity to set the standards for Medicaid participation “was no inconsequential matter,” according to Alito. Rather, he said, “It has cost the States hundreds of millions of dollars.”

Still, the Court will not consider the case in its current posture — a decision Alito was clear to lay at the feet of the federal government itself. As the Biden administration argued, Congress has already repealed the tax involved in the case, so no future injury will result from its arguably improper standards. Further, the government contends that the six-year statute of limitations has run on the HHS rule (which was adopted in 2o02). Those procedural “complications” raised by the government convinced Justices Alito, Thomas and Gorsuch to “reluctantly concur in the denial of certiorari.”

The conservative trio ended their brief statement with something of a warning shot, though: “However, if the determinations of the Actuarial Standards Board have any future effect, review should be granted in an appropriate case.”

[image via Erin Schaff-Pool/Getty Images]