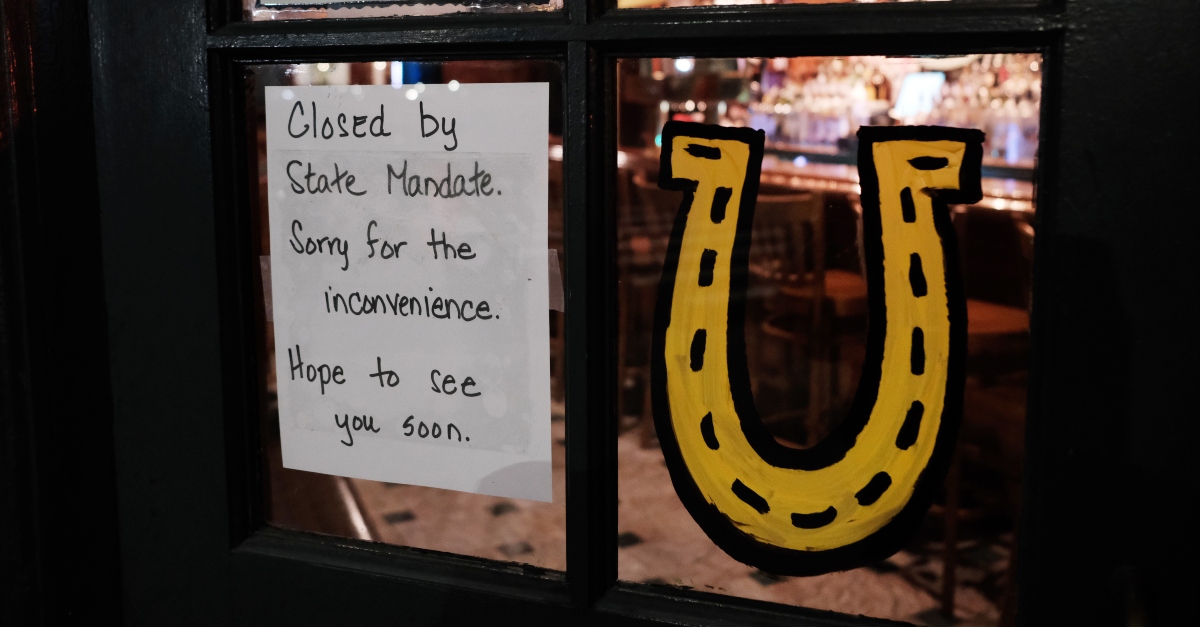

Brooklyn restaurant closed amid coronavirus outbreak

It is no surprise that COVID-19 is wreaking havoc on the U.S. economy. In particular, small businesses have been especially hit hard. According to a recent report from the U.S. Chamber of Commerce, “54% of all small businesses report they are closed or could close within the coming weeks.”

Yet, with the recent passage of the Coronavirus Aid, Relief, and Economic Security Act (CARES), the federal government is offering specialized loan and financial aid packages to these businesses. The question though, how do you even go about getting any of it? We have some answers.

The first question is what kind of loan do you need and does your business qualify? The Small Business Administration (SBA) is the federal agency overseeing and managing the relief programs. While there are obviously traditional funding options through the SBA, the agency lists out on their website, the four main options created or expanded through CARES to help small businesses:

- Paycheck Protection Program (PPP)

- Economic Injury Disaster Loan Emergency Advance (EIDL)

- SBA Express Bridge Loans

- SBA Debt Relief

Paycheck Protection Program

Under the PPP, a small business can receive a loan from a lender for up to 2.5x its monthly payroll with a ceiling at $10 million to be used over an eight-week period. Not only that, but a business won’t even have to pay back the loan IF the money is used strictly to finance payments for rent, mortgage, utilities and at least 75% on payroll. Payroll costs include salaries, wages, commissions, tips, employee benefits, and taxes assessed on compensation.

However, if a business decides to terminate a number of its employees, pays less in compensation or starts using the money for other purposes, then the loan will not be forgiven. In that case, a 1% interest rate is assessed on the loan, which will be payable over the course of 2 years, but a business will not have to start repaying the loan for 6-months.

PPP is open to the following:

- All businesses with 500 or fewer employees, including nonprofits, veterans groups, tribal business organizations, sole proprietorships, self-employed people, and independent contractors

- Businesses with more than 500 employees if they meet sizing standards (check here)

- Listed members of the hospitality and food industry (check here)

- Specific franchises (check here)

- Small businesses that receive financial aid from SBA licensed investment organizations

To apply for this program, which lasts until June 30, 2020, fill out this form: https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Application-3-30-2020-v3.pdf. Next, you’ll submit this form to a lender.

This site lists out qualified lenders near you: https://www.sba.gov/paycheckprotection/find.

Aside from the application form, you’ll need to present your lender with payroll information too, such as, your list of employees, their pay rates, and an accounting of lease, mortgage, and utility payments.

The PPP option is attractive in that no collateral or guaranty will need to be put forth to receive this loan, plus there are no SBA or agent fees.

This information-sheet prepared by the Treasury Department provides more details on the PPP loan.

Economic Injury Disaster Loan Advance

The EIDL generally refers to loans the government, not a lender, disburses to businesses in the event of catastrophes that can go as high as $2 million. The interest rate on this loan is 3.75% for small businesses and 2.75% for private, not-for-profits that may be payable over the course of 30 years. The money is to be used to cover expenses and debts that a business is struggling to pay because of COVID-19. It is not meant for a variety of other purposes, such as to refinance debt, issue dividends or bonuses, make repairs, improvements or acquisitions, or to generally pay out owners or pay back stockholder or principal loans. Pages 75-76 of an SBA guideline on EIDL loans lists out all the ineligible uses.

This program also offers something a lot of cash-strapped businesses may need….an immediate $10,000 payment. Not only is a business not required to repay this advance, but it can receive the money even if it does not qualify for the larger EIDL loan. The SBA claims the $10,000 will be delivered “within days of a successful application.”

To apply, visit this website: https://covid19relief.sba.gov/#/. Businesses will need to provide the SBA with basic company information, such as gross revenues, operating expenses, cost of goods solds, and number of employees, but may also be asked to provide additional documents like a profit and loss statement as well as federal tax returns. Additionally, the SBA requires a business to certify that it meets strict requirements in order to receive the funds, including that it is not engaged in illegal activity or lobbying, is not a government entity and a major principal isn’t late on child support.

This EIDL program is open to most of the businesses that would qualify under the PPP with some exceptions.

SBA Express Bridge Loan

The SBA Express Bridge Loan is for businesses that have already applied for longer-term funding from an SBA Express Lender but are in need of emergency cash due to a disaster (i.e. coronavirus pandemic). Under this program, businesses can receive up to $25,000 to hold them over in the meantime. This option is operational through March 13, 2021.

In order to qualify for this loan, a business must have been in operation as of March 13, 2020 and had to be negatively impacted by the COVID-19 crisis. The money must be “disbursed as working capital” and used “to support the survival and/or reopening of the small business.”

The SBA has a comprehensive guide on this: https://www.sba.gov/sites/default/files/2020-03/Express-Bridge-Loan-Pilot-Program-Guide-FINAL-3.25.20.pdf.

Pages 7-11, list out all the forms that a business would need to fill out, eligibility requirements as well as the fees and interest rates on the loan.

SBA Debt Relief

SBA Debt Relief concerns businesses that have already taken out SBA 7(a), 504, or microloans. The government will now automatically cover the principal, interest and fees of current loans as well as loans taken out prior to September 27, 2020 for a period of six months.

Also under this initiative, the SBA explains if a small business already had an SBA Serviced Disaster (Home and Business) Loan that was in “regular servicing” as of March 1, 2020, payments on the loan are automatically put on hold for six months. However, if a business set up a recurring payment or “Preauthorized Debit” system online, then it would have to protectively cancel those payments.

For both the SBA Express Bridge loan and Debt Relief programs, you’ll want to contact the SBA and your lender just to confirm what you can do.

While these financial programs established by the federal government are strong measures to grant relief to small businesses, owners should be aware that the system may not be without faults. Since the launch of the PPP program last week, there have been technical errors in processing and issues with lender preparedness that have resulted in delays and confusion. Possibly in response to the faulty rollout of this program, Senate Majority Leader Mitch McConnell announced he is working on passing further legislation to provide economic support to small businesses.

[Image via Spencer Platt/Getty Images]