A “Department of Justice” sign is seen on the wall of the US Department of Justice building in Washington, DC on April 18, 2019.

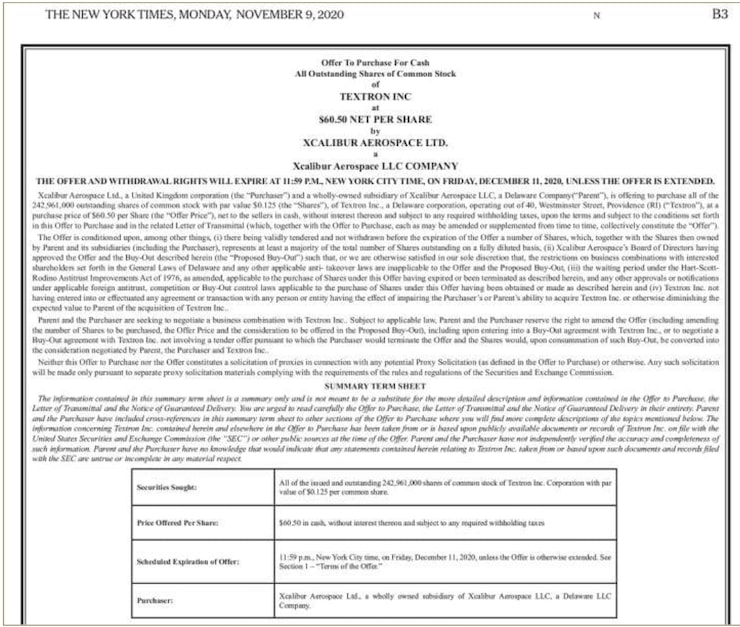

On Nov. 9, 2020, an advertisement ran in The New York Times claiming that a company named Xcalibur Aerospace, Ltd. had secured $11 billion in financing to purchase a Fortune 500 company, authorities say.

That defense company, Textron, ranked 265th in the magazine’s rankings last year, and the ad proposed buying all of its existing stock at $60.50 a share, a figure that authorities say would have represented a 56 percent premium over the stock’s previous closing price. It wold have cost more than than $14 billion to complete, according to court papers.

On Tuesday, federal prosecutors and regulators alleged that it was all an elaborate fraud spearheaded by a dual U.S.-Dutch national named Melville ten Cate, who now stands accused of four criminal counts of fraud.

“Fraudsters talk big and hope no one looks too closely at the bottom line,” U.S. Attorney for the Southern District of New York Damian Williams wrote in a statement. “We allege Mr. ten Cate attempted to make his company look profitable and bluffed his way through the proposed purchase of a multi-billion dollar company. But it was all based on a lie. Instead of collecting on a hefty payday, he’s now facing serious federal charges.”

Ten Cate and his now-defunct company, Xcalibur, also face regulatory action by the Securities and Exchange Commission.

“We allege that the defendant, ten Cate, pretended to run a financially viable business while leaving a trail of bad debts that included never paying for the very advertisement that announced the fictitious offer,” Carolyn Welshhans, the SEC’s Associate Director from the Division of Enforcement, said in a statement.

Though authorities say that ten Cate’s advertisements were false, regulators claim they made the markets move.

“After the announcement of Xcalibur’s fraudulent tender offer, Textron’s common stock price rose approximately 15% before market close on November 9,” the SEC’s complaint states. “Its trading volume was approximately 450% higher than during the prior trading day, causing the New York Stock Exchange (‘NYSE’) to halt trading in Textron’s shares.”

Well before the advertisement ran, Textron allegedly knew something was amiss with Xcalibur and ten Cate. Regulators say that ten Cate sent the company the purported tender offer for $66 per share on Jan. 4, 2019.

“In response, ten Cate provided a number of documents to Textron concerning Xcalibur’s purported financial condition, including documents stating that Xcalibur earned approximately £161 million in revenue for 2018, and that in January 2019, Xcalibur had received a $6.4 billion investment from a member of the Saudi Royal family,” the complaint states.

Textron then looked into the deal, authorities say.

“An investigation of ten Cate undertaken by Textron revealed a host of business failures, questionable commercial dealings, unpaid debts, and allegations of fraud, including attempts to deceive the governments of Iceland and Spain,” the complaint states.

The SEC says that Textron ultimately concluded that the offer “lacked credibility.”

Ten Cate reached out to the company again on Feb. 28, 2020, an overture which the company ignored, according to court papers.

The Times ultimately ran the tender offer on B3.

This New York Times ad was embedded in the SEC’s complaint against ten Cate.

“Upon The New York Times’ request for advanced payment, ten Cate provided an international bank wire receipt indicating payment from a purported Swiss bank account,” the SEC complaint states. “However, no such bank account existed. The New York Times was never paid for the advertisement.”

The identities of the Times and Textron are shielded in ten Cate’s indictment but revealed in the SEC’s complaint.

Read the DOJ’s indictment and the SEC’s complaint, below:

(Photo by CHANDAN KHANNA/AFP via Getty Images)