The onslaught of COVID-19 is placing Americans in precarious financial positions. A major concern is falling behind on payments to various creditors and lenders, which would adversely affect a credit score. Is there a way to protect yourself? Yes, let’s discuss.

What Is a Credit Score?

A credit score is a representation to a lender or creditor of how trustworthy you are as a borrower. As major credit reporting bureau Equifax states, it is “a three-digit number, typically between 300 and 850, designed to represent your credit risk, or the likelihood you will pay your bills on time.” It is a calculation based on “your payment history, the amount of debt you have, and the length of your credit history.” Equifax lists out the ranges as so forth:

- “300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800-850: Excellent”

“Those with higher credit scores generally receive more favorable credit terms, which may translate into lower payments and less paid in interest over the life of the account,” Equifax explains.

Given the shutdown orders across the nation, and despite the government’s financial assistance programs, people face the reality of not having enough money to pay their debts (e.g., student loans, mortgage obligations, credit card payments) on time, resulting in negative credit reporting and downgrades of their credit scores.

Your Credit Score

The first step in protecting your credit score is to do an accounting. Make a list of all your current credit and loan obligations. You’ll need to then ensure that your credit score and credit report (i.e., credit history) are accurate. AnnualCreditReport.com will provide a free credit report to you every year. Credit scores, which are generated by different analytics companies, are available at numerous websites, such as Credit Sesame, LendingTree, and FICO.

Contact Your Lender/Creditor

Assuming you are unable to make the minimum payments authorized under your loan or credit agreement, the next step is to immediately contact your lender or creditor and negotiate a revised payment arrangement before you start failing to make payments by the due dates. Why the urgency? Under Congress’s recent passage of the “Coronavirus, Aid, Relief, and Economic Security Act” (CARES Act), the federal government added safeguards to consumers, who are otherwise not delinquent, but are about to get in financial trouble. Section 4021 of the CARES Act amends Section 623(a)(1) of Fair Credit Reporting Act (15 U.S.C. 1681s–2(a)(1)) by prohibiting lenders and creditors from issuing negative reports on a consumer to credit bureaus if a new agreement has been reached with the consumer:

If a furnisher makes an accommodation with respect to 1 or more payments on a credit obligation or account of a consumer, and the consumer makes the payments or is not required to make 1 or more payments pursuant to the accommodation, the furnisher shall (I) report the credit obligation or account as current.

CARES makes it clear that this protection does not extend to debts or payments that were overdue or late before the “accommodation,” and the lender or creditor must “maintain the delinquent status.” In other words, Section 4021 only protects your credit score from going down as a result of COVID-19 complications and only if you have reached an agreement with your bank, credit card company or other lending or crediting agency.

CARES defines potential “accommodations” between you and a lender or creditor as including “an agreement to defer 1 or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or any other assistance or relief granted to a consumer who is affected by the coronavirus disease 2019 (COVID–19) pandemic during the covered period.” Financial institutions have followed suit. American Express, Bank of America, and Citi, are just a few of the companies offering relief programs, such as lowering of monthly credit card payments, deferral of car and home payments, and fee waivers. Contact your lender or creditor to inquire what packages are being offered in response to the coronavirus.

Additional Steps

While negotiating new terms of existing lending and crediting arrangements is a way to stop current hits to your credit score, you’ll also want to develop a plan moving forward, especially given the uncertainty of how long the shutdown orders will remain in effect or the far-reaching impact COVID-19 will have on the U.S. economy.

It is important to manage your finances and perhaps develop a reformulated budget so as not to endanger your credit score. The National Foundation For Credit Counseling (NFCC), is a non-profit that may be able to assist you by offering financial counseling and up-to-date information regarding the pandemic. You can contact them either online or by phone, 1-800-388-2227.

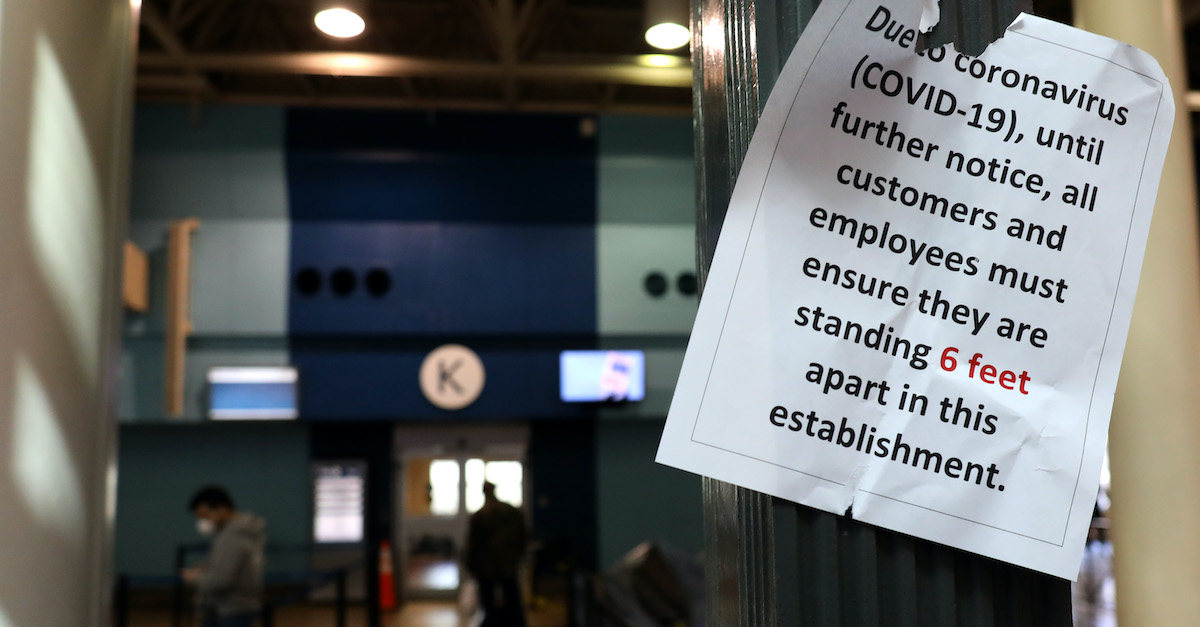

[Image via Rob Carr/Getty Images]