Ratcheting up pressure on President Joe Biden on a key goal of his party’s left flank, a group of Democratic Attorneys General urged House and Senate leadership in a letter on Friday to adopt resolutions calling on the commander in chief to use his executive authority under the Higher Education Act to cancel up to $50,000 in debt for “each and every Federal student loan borrower.”

Biden has resisted such calls, which have now been amplified by 15 chief law enforcement officers throughout the country, including his party’s rising stars.

What is the Higher Education Act?

Signed into law in 1965 by then-President Lyndon B. Johnson, the HEA began as part of Johnson’s “Great Society” program for the purpose of “strengthen[ing] the educational resources of our colleges and universities and to provide financial assistance for students in postsecondary and higher education.” The Act was reauthorized several times (and amended) over the ensuing decades.

Resolutions exist in both the House and Senate, using identical language to say that Biden should use his executive authority to direct the Secretary of Education to use powers available under the Higher Education Act to cancel student debt.

Senate Democrats and the Legal Services Center of Harvard University have each pointed to 20 U.S.C. § 1082(a), which notes that the Secretary of Education (Biden’s nominee is Dr. Miguel Cardona) can (placing emphasis) “enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.”

Congressional resolutions jointly say Biden should “broadly cancel Federal student loan debt,” particularly but not only because of the strain caused by the COVID-19 pandemic.

“Whereas canceling up to $50,000 in Federal student loan debt per borrower is the most equitable way to ensure the benefits of cancellation reach the borrowers most in need of relief because that action would lift a disproportionate number of low-income borrowers and Black and Latino borrowers completely out of student debt, including nearly 90 percent of all borrowers in the lowest income quintile and over 90 percent of Black and Latino borrowers in the lowest income quartile,” H. Res. 100 says, in part.

What the Attorneys General are saying

New York Attorney General Letitia James and Massachusetts Attorney General Maura Healy headlined the letter, joined by 15 other Democratic AGs: William Tong (Conn.), Kathleen Jennings (Del.), Clare Connors (Hawaii), Kwame Raoul (Ill.), Brian Frosh (Md.), Keith Ellison (Minn.), Aaron Ford (Nev.), Gurbir Grewal (N.J.), Hector Balderas (New Mexico), Ellen Rosenblum (Ore.), Thomas Donovan Jr. (Vt.), Mark Herring (Va.), Bob Ferguson (Wash.), Josh Kaul (Wisc.), and Karl Racine (D.C.).

The attorneys general say the pandemic has exacerbated longstanding problems and will leave many Americans, especially minority communities who are being disproportionately impacted by COVID-19, in a permanent state of hardship:

Student loan borrowers were already struggling before the COVID-19 pandemic and recession. Many borrowers already owed more than they originally borrowed. As many as one in five Federal student loan borrowers are in default. Many are unable to manage their debt due to disability, illness, or job loss. A growing number are senior citizens living on low fixed incomes. Struggling borrowers are unable to obtain meaningful relief in bankruptcy because under current law, Federal student loans are not dischargeable except under extremely narrow circumstances.

Many struggling borrowers are victims of predatory for-profit colleges that lure students with false promises and leave them with worthless degrees, few job prospects, and insurmountable debt. Our Offices have expended substantial resources combatting misconduct by for-profit colleges. Through these efforts, we know that students who attend for-profit schools are disproportionately likely to suffer dire consequences from the Federal student loans they obtain to pay their tuition. Significantly, the for-profit school industry has deliberately targeted people of color, who, as a result, are disproportionately represented among students struggling with Federal student loans incurred to attend for-profit schools. Student debt cancellation can substantially increase Black and Latinx household wealth and help close the racial wealth gap.

Attorney General James said in statement that doing nothing to address student loan debt will prevent “too many struggling borrowers” from “achieving financial stability.”

“Many fall behind on their payments or enter default, leading to a downward spiral of ruined credit and dashed dreams. Cancelling up to $50,000 in student loan debt will not only free these borrowers to move forward with their lives, but will simultaneously help close the racial wealth gap and move our economy to new heights. This is about creating equal footing among all students and giving every borrower the opportunity to succeed,” James said.

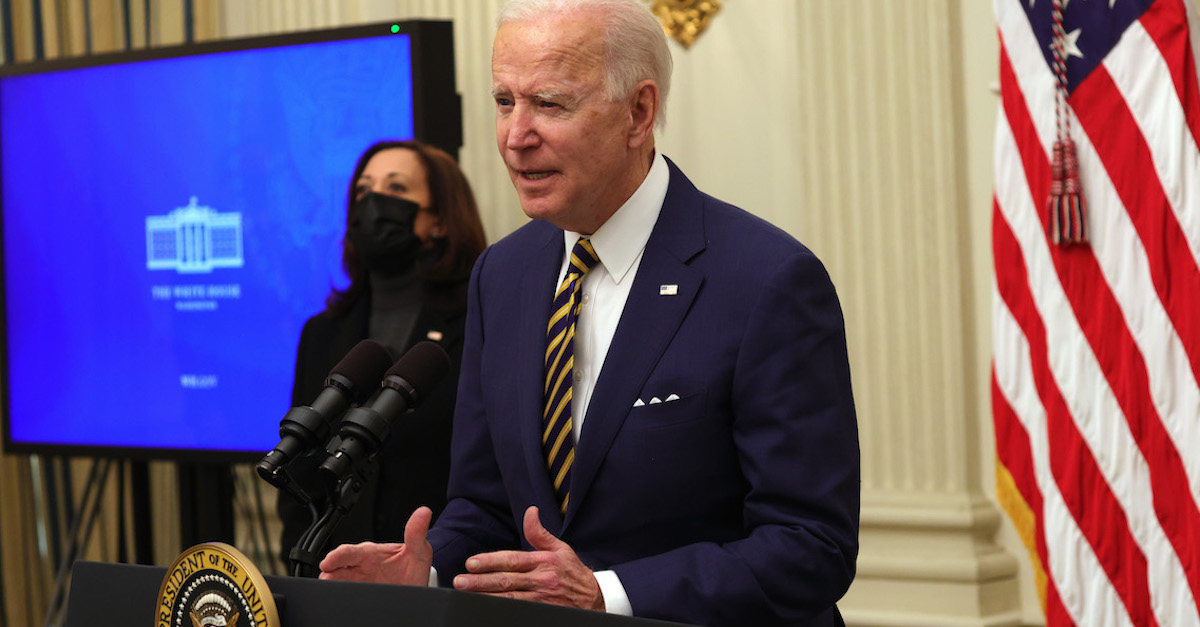

[Image via Alex Wong/Getty Images]